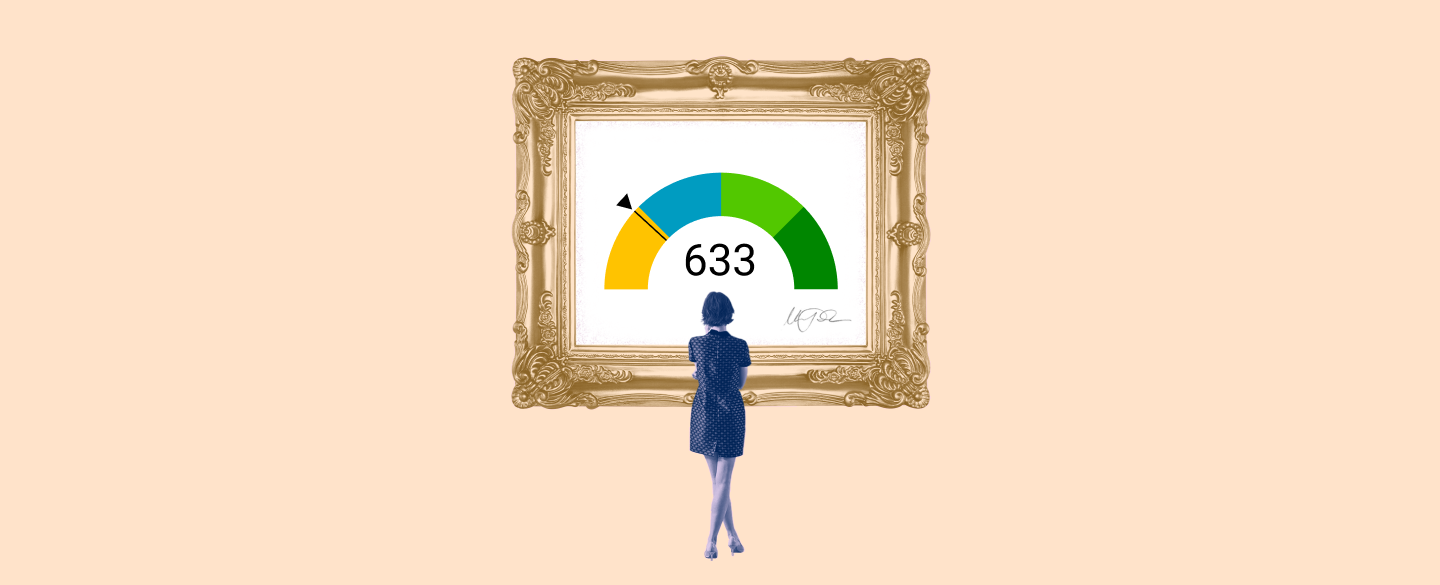

A FICO Score of 633 is a common credit score, but it doesn't necessarily reflect what kind of consumer you are. Your credit score can help lenders determine your level of risk for borrowing money; the higher the score, the more likely you might be to repay a loan. Learning about your credit score can be valuable in deciding how to manage your financial future.

Table Of Content:

- 633 Credit Score: Is it Good or Bad?

- 633 Credit Score: What Does It Mean? | Credit Karma

- Is 633 a Good Credit Score? Rating, Loans & How to Improve

- Is 633 a good credit score? | Lexington Law

- 633 Credit Score (+ #1 Way To Fix It )

- 633 Credit Score: Good or Bad? | Credit Card & Loan Options

- 633 Credit Score Mortgage Lenders in 2022 - Non-Prime Lenders ...

- 633 Credit Score – Is it Good or Bad? How to Improve Your 633 ...

- What's Considered a Good Credit Score? | TransUnion

- Can I Refinance With A 633 Credit Score

1. 633 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/633-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 633 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 633 FICO® Score is below the average credit score.

2. 633 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/633 Apr 30, 2021 ... A 633 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 633 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 633 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/633-credit-score/

A credit score of 633 isn't “good.” It's not even “fair.” Rather, a 633 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. Is 633 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/633 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 633 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/633-credit-score

Jun 11, 2022 ... A 633 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 633 Credit Score. Lenders ...

6. 633 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/633/ Nov 9, 2021 ... 633 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 633 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

7. 633 Credit Score Mortgage Lenders in 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/633-credit-score-mortgage/

FHA Loan with 633 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 633 FICO, you can definitely meet the credit score ...

8. 633 Credit Score – Is it Good or Bad? How to Improve Your 633 ...

https://www.creditrepairexpert.org/633-credit-score/ How to Improve Your 633 FICO Score. Before you can do anything to increase your 633 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 633 FICO Score. Before you can do anything to increase your 633 credit score, you need to identify what part of it needs to be improved, ...

9. What's Considered a Good Credit Score? | TransUnion

https://www.transunion.com/blog/credit-advice/whats-considered-a-good-credit-score Dec 10, 2021 ... A good credit score can help you get approved and lock in better rates for loans and other credit. Higher is generally better, but it's hard to ...

Dec 10, 2021 ... A good credit score can help you get approved and lock in better rates for loans and other credit. Higher is generally better, but it's hard to ...

10. Can I Refinance With A 633 Credit Score

https://www.fha-world.com/refinance-with-a-633.html Can I refinance with a 633 credit score? Yes you can I refinance with a 633 credit score. FHA requires a minimum credit score of 500 to refinance.

Can I refinance with a 633 credit score? Yes you can I refinance with a 633 credit score. FHA requires a minimum credit score of 500 to refinance.

What is a 633 credit score?

A 633 credit score is a common credit rating that most widely used scoring model, FICO, uses as an indicator of a consumer's risk associated with their borrowing activity. It falls within the "Fair" category on the FICO scale, and indicates that, although there may have been some adverse borrowing history in the past, lenders may still consider taking on some level of risk when working with this person.

What actions can I take to improve my 633 Credit Score?

There are several methods to improve your 633 credit score. These include establishing positive payment history by making all payments on time, keeping your utilization rate low, using installment loans responsibly and avoiding opening too many accounts at once. Additionally, adding positive activity such as an auto-payment plan or secured revolving loan may also help improve your overall standing with lenders.

How long does it take for my 633 Credit Score to improve?

The amount of time it takes for a 633 credit score to improve will depend on several factors including age of debt owed and frequency or severity of any past negative events being reported against you by creditors or collection agencies. That said, responsible borrowing behavior over time can certainly lead to sustained improvement in your overall standing with potential lenders.

Will having a 633 Credit Score impact my ability to get approved for certain loans?

Having a 633 credit score may affect one's ability to obtain approval for certain loans since this rating often signals that one may pose more inherent risk than other borrowers who have higher scores or longer histories of responsible borrowing habits. Taking steps such as increasing one's payment history or reducing levels of current debt could help increase chances of approval depending on the specific criteria set forth by individual lenders offering those specific loan products desired.

Is there anything beyond my credit score I should look out for when applying for a loan?

While understanding one's own personal credit situation is key when applying for any type of loan product, it would also be wise to monitor things like employment stability and income trends when assessing whether or notcertain loans are suitable or affordable currently or in the future. Additionally understanding certain details associated with each loan such as origination fees and interest rates should be taken into consideration prior to signing any contract as well.

Conclusion:

Overall, having a FICO Score of 633 means that there could potentially be opportunities available from willing lenders if you have taken charge and made amends necessary for improving your current rating gradually overtime while exhibiting responsible behavior moving forward- but it’s important that consumers understand exactly what they're getting into before moving ahead with any major financial decisions.