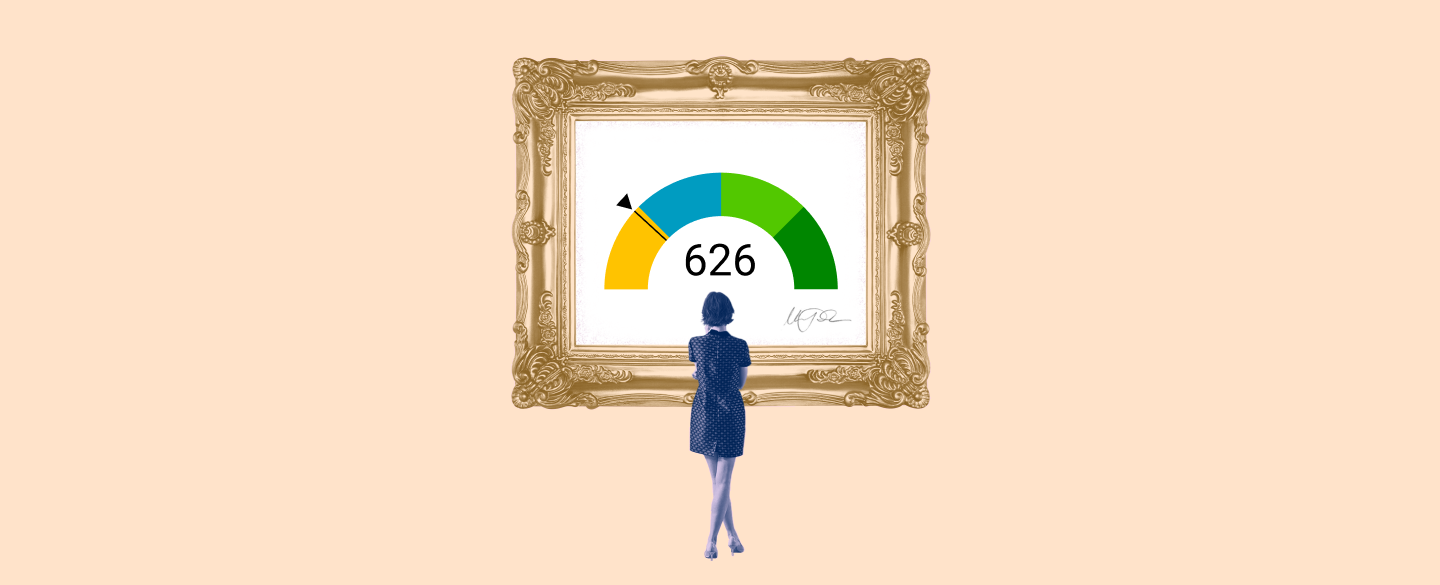

A 626 credit score home loan is a special type of mortgage that allows you to finance a home purchase even if your credit score is not perfect. It is designed to make homeownership more accessible to people with lower credit scores who otherwise may struggle to qualify for conventional bank or other financial institution financing.

Table Of Content:

- 626 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 626 Credit Score: Is it Good or Bad?

- FHA Loan Credit Score Requirements For 2022 | Quicken Loans

- What Credit Score Do You Need To Buy A House? | Rocket Mortgage

- 626 Credit Score: What Does It Mean? | Credit Karma

- 626 Credit Score (+ #1 Way To Fix It )

- Is 626 a Good Credit Score? Rating, Loans & How to Improve

- 626 Credit Score: Good or Bad? | Credit Card & Loan Options

- FHA Credit and Your FHA Loan in 2022

- Can 626 be considered a good credit score for a car loan? | Jerry

1. 626 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/626-credit-score-mortgage/

If your credit score is a 626 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

2. 626 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/626-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 626 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 626 FICO® Score is below the average credit score.

3. FHA Loan Credit Score Requirements For 2022 | Quicken Loans

https://www.quickenloans.com/learn/fha-loan-credit-score Nov 19, 2021 ... If you have a FICO® Score above 580 but below 620, you'll need to maintain a housing expense ratio of no more than 38% of your gross income and ...

Nov 19, 2021 ... If you have a FICO® Score above 580 but below 620, you'll need to maintain a housing expense ratio of no more than 38% of your gross income and ...

4. What Credit Score Do You Need To Buy A House? | Rocket Mortgage

https://www.rocketmortgage.com/learn/what-credit-score-is-needed-to-buy-a-house May 26, 2022 ... Credit plays a big role in getting a home loan. Learn what credit score you'll need to buy a house, and which loans are best for certain ...

May 26, 2022 ... Credit plays a big role in getting a home loan. Learn what credit score you'll need to buy a house, and which loans are best for certain ...

5. 626 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/626 A 626 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for ...

A 626 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for ...

6. 626 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/626-credit-score

Jun 11, 2022 ... A 626 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 626 Credit Score. Lenders ...

7. Is 626 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/626-credit-score/

A credit score of 626 isn't “good.” It's not even “fair.” Rather, a 626 credit score is actually considered “bad,” according to the standard 300 to 850 ...

8. 626 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/626/ Nov 9, 2021 ... Loans and Credit You Can Get with a 626 Credit Score ... Installment loans, Mortgage, Eligible for most types of mortgages, ...

Nov 9, 2021 ... Loans and Credit You Can Get with a 626 Credit Score ... Installment loans, Mortgage, Eligible for most types of mortgages, ...

9. FHA Credit and Your FHA Loan in 2022

https://www.fha.com/fha_credit Are You Watching Your Credit Score? NOTICE: Some FHA mortgage lenders are substantially raising FICO score requirements during the Coronavirus crisis, even ...

Are You Watching Your Credit Score? NOTICE: Some FHA mortgage lenders are substantially raising FICO score requirements during the Coronavirus crisis, even ...

10. Can 626 be considered a good credit score for a car loan? | Jerry

https://getjerry.com/questions/can-626-be-considered-a-good-credit-score-for-a-car-loan![]() Can I take out a car loan with a 626 credit score? This is my first time financing a car. ... Here to save on car and home insurance? Great, you do that.

Can I take out a car loan with a 626 credit score? This is my first time financing a car. ... Here to save on car and home insurance? Great, you do that.

What are the advantages of a 626 credit score home loan?

The main advantage of a 626 credit score home loan is that it allows you to become a homeowner despite having a lower credit score. This type of loan also offers flexible terms, low down payments, and competitive interest rates.

Who qualifies for this type of loan?

Most lenders have criteria for qualification which usually involves having at least a minimum FICO Score of 600-625, depending on the lender's guidelines. You'll also need to show proof of income, employment history and meet other eligibility criteria specific by the lender.

How do I know if I am eligible for this type of loan?

The best way to determine if you're eligible for this type of loan is by completing an online pre-qualification form and submitting it with current information about your financial situation such as income, assets, debts and credits scores so the lender can assess your eligibility.

What types of documents will I need to provide?

The documents required vary from one lender to another but generally you will need to provide proof of identity, address, income statements and tax returns. Other documentation such as bank statements or pay stubs may also be requested during the approval process.

How long does it take to get approved for a 626 credit score home loan?

It typically takes about two weeks after submitting all documentation needed in order to be approved for the loan. However, in some cases it may take longer depending on individual circumstances and requirements from the lender.

Conclusion:

A 626 Credit Score Home Loan is a great option for people looking to purchase a home but don’t have perfect credit scores due its attractive terms and competitive interest rates that make homeownership achievable. If you think you qualify then contact your local mortgage professional today!