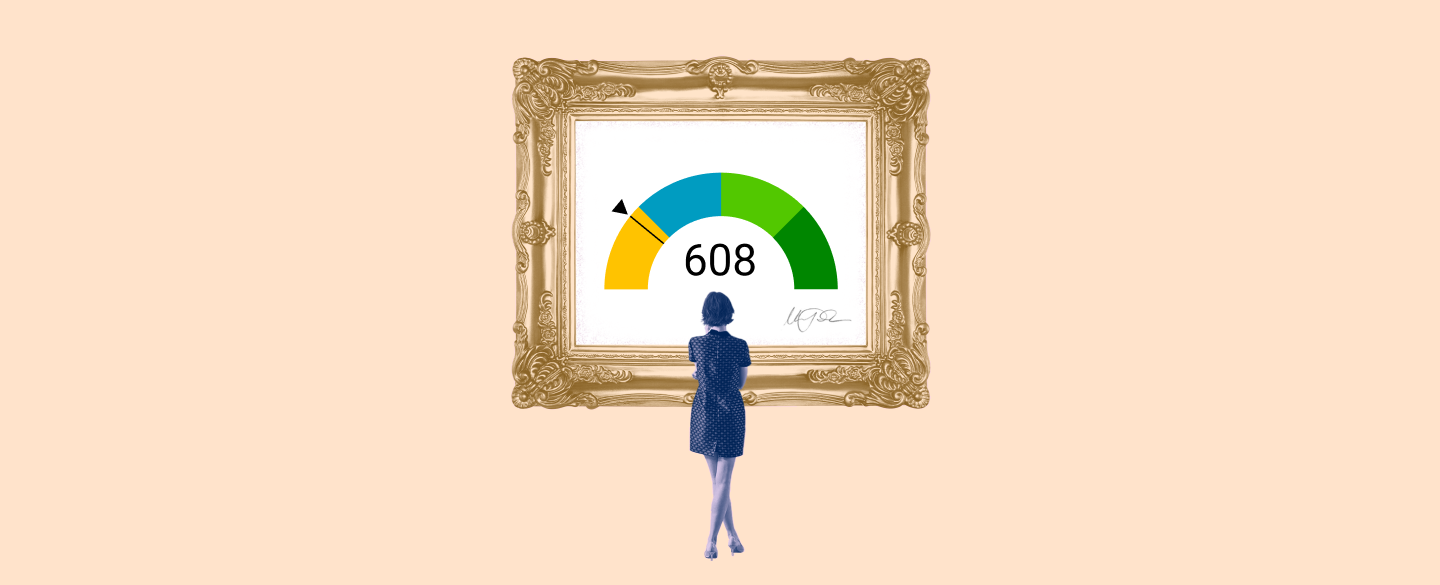

Your credit score is the most important factor that lenders look at when deciding whether to approve or reject a loan. A 608 credit score is considered fair and can be improved with some simple steps. This article will explain what a 608 credit score means and how you can work to improve it

Table Of Content:

- 608 Credit Score: Is it Good or Bad?

- Is 608 a Good Credit Score? Rating, Loans & How to Improve

- 608 Credit Score: What Does It Mean? | Credit Karma

- Is 608 a good credit score? | Lexington Law

- 608 Credit Score (+ #1 Way To Fix It )

- 608 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 608 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score Do You Need To Buy A House? | Rocket Mortgage

- 608 Credit Score – Is it Good or Bad? How to Improve Your 608 ...

- 608 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 608 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/608-credit-score/ A FICO® Score of 608 places you within a population of consumers whose credit may be seen as Fair. Your 608 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 608 places you within a population of consumers whose credit may be seen as Fair. Your 608 FICO® Score is lower than the average U.S. credit ...

2. Is 608 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/608-credit-score/

A credit score of 608 isn't “good.” It's not even “fair.” Rather, a 608 credit score is actually considered “bad,” according to the standard 300 to 850 ...

3. 608 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/608 Apr 30, 2021 ... A 608 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 608 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. Is 608 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/608 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 608 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/608-credit-score

6. 608 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/608-credit-score-mortgage/

The most common type of loan available to borrowers with a 608 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, so with a ...

7. 608 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/608-credit-score/ Is 608 a good credit score? FICO scores range from 300 to 850. As you can see below, a 608 credit score is considered Fair.

Is 608 a good credit score? FICO scores range from 300 to 850. As you can see below, a 608 credit score is considered Fair.

8. What Credit Score Do You Need To Buy A House? | Rocket Mortgage

https://www.rocketmortgage.com/learn/what-credit-score-is-needed-to-buy-a-house May 26, 2022 ... After all, your FICO® Score is reported by three different bureaus. If you're applying for a loan on your own, lenders get your credit score ...

May 26, 2022 ... After all, your FICO® Score is reported by three different bureaus. If you're applying for a loan on your own, lenders get your credit score ...

9. 608 Credit Score – Is it Good or Bad? How to Improve Your 608 ...

https://www.creditrepairexpert.org/608-credit-score/ How to Improve Your 608 FICO Score. Before you can do anything to increase your 608 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 608 FICO Score. Before you can do anything to increase your 608 credit score, you need to identify what part of it needs to be improved, ...

10. 608 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/608-credit-score/ A 608 credit score is considered as “poor” score. While people with the 608 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 608 credit score is considered as “poor” score. While people with the 608 FICO score won't have as much trouble getting loans as those with lower credit, ...

What does a 608 credit score mean?

A 608 credit score falls within the range of "Fair" scores on the FICO® Score 8 scale, meaning it's not good enough for the best offers, but could still be acceptable to some lenders. The average American has a 687 credit score, so your score is below average. However, there are still many loan options available to those with this credit score.

How can I increase my 608 credit score?

There are several steps you can take to increase your 600 8credit score. First, pay all your bills on time as this accounts for 35% of your FICO® Score calculation. You should also reduce any debt you may have and try to keep your outstanding balances low relative to your limit across all accounts. Finally, try limiting new applications for credit as each inquiry can lower your overall score by several points.

Who looks at my 608 credit score?

Potential creditors like banks and other lenders use your credit report and associated scores in assessing you for any potential loans or lines of credits you may qualify for. Insurance companies may also check your credit score when determining insurance premiums, so it's important to maintain a healthy one if possible.

Conclusion:

Having a 608credit score means that while you won’t get the best deals available, there are still plenty of loan choices available to someone with this number. To improve it further over time, make sure you pay all bills on time, reduce any debt owed and limit new applications for credits as much as possible..