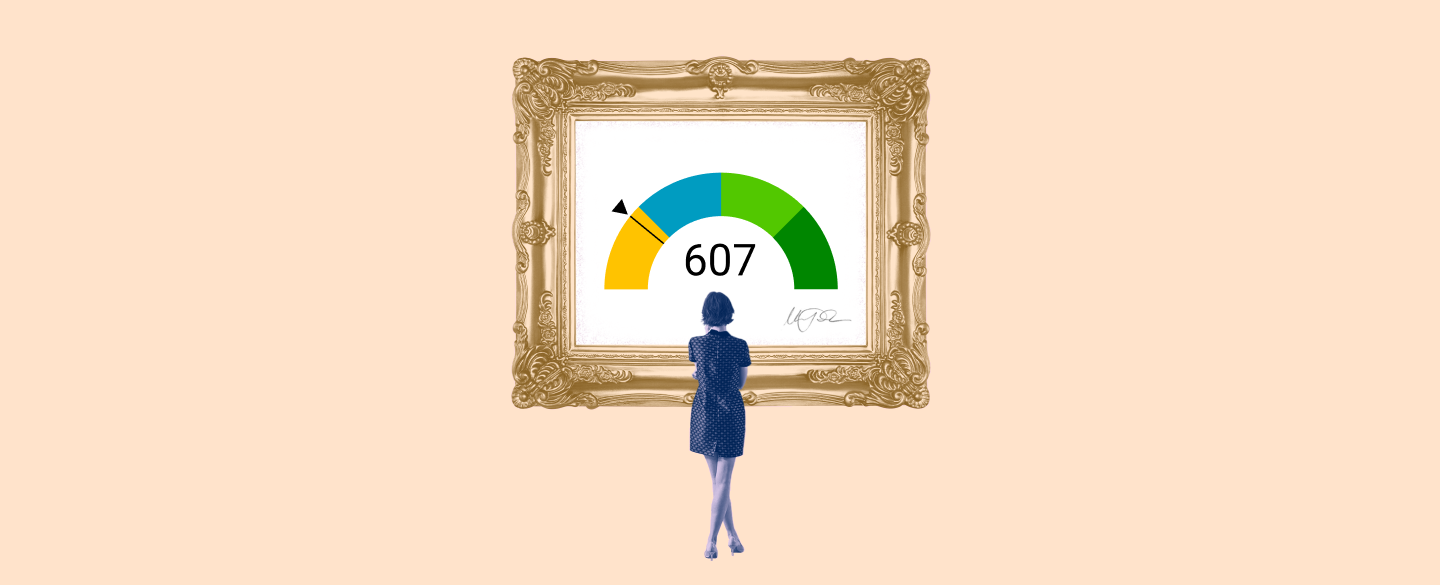

A 607 credit score is an excellent sign of financial health and responsibility. It is considered a ‘fair’ credit score, which means that you should have access to many loan options and be able to obtain favorable rates. This is an important piece of information for lenders who prefer to work with borrowers with good credit standings.

Table Of Content:

- 607 Credit Score: Is it Good or Bad?

- Is 607 a Good Credit Score? Rating, Loans & How to Improve

- 607 Credit Score: What Does It Mean? | Credit Karma

- 607 Credit Score (+ #1 Way To Fix It )

- Can I get a car loan with a credit score of 607? | Jerry

- 607 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 607 Credit Score: Is it Good or Bad? (Approval Odds)

- 607 Credit Score – Is it Good or Bad? How to Improve Your 607 ...

- 607 Credit Score: Good or Bad? | Credit Card & Loan Options

- 607 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 607 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/607-credit-score/ A FICO® Score of 607 places you within a population of consumers whose credit may be seen as Fair. Your 607 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 607 places you within a population of consumers whose credit may be seen as Fair. Your 607 FICO® Score is lower than the average U.S. credit ...

2. Is 607 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/607-credit-score/

A credit score of 607 isn't “good.” It's not even “fair.” Rather, a 607 credit score is actually considered “bad,” according to the standard 300 to 850 ...

3. 607 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/607 Apr 30, 2021 ... A 607 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 607 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. 607 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/607-credit-score

Jun 11, 2022 ... A 607 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 607 Credit Score. Lenders ...

5. Can I get a car loan with a credit score of 607? | Jerry

https://getjerry.com/questions/can-i-get-a-car-loan-with-a-credit-score-of-607![]() Feb 24, 2022 ... Don't worry too much, though—you can totally find a decent car loan with a score of 607. A 607 credit score is considered nonprime, so you can ...

Feb 24, 2022 ... Don't worry too much, though—you can totally find a decent car loan with a score of 607. A 607 credit score is considered nonprime, so you can ...

6. 607 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/607-credit-score-mortgage/

The most common type of loan available to borrowers with a 607 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, so with a ...

7. 607 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/607-credit-score/ FICO scores range from 300 to 850. As you can see below, a 607 credit score is considered Fair. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 607 credit score is considered Fair. Credit Score, Credit Rating, % of population.

8. 607 Credit Score – Is it Good or Bad? How to Improve Your 607 ...

https://www.creditrepairexpert.org/607-credit-score/ Before you can do anything to increase your 607 credit score, you need to identify what part of it needs to be ... How to Improve Your 607 FICO Score.

Before you can do anything to increase your 607 credit score, you need to identify what part of it needs to be ... How to Improve Your 607 FICO Score.

9. 607 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/607/

Nov 9, 2021 ... 607 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

10. 607 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/607-credit-score/ A 607 credit score is considered as “poor” score. While people with the 607 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 607 credit score is considered as “poor” score. While people with the 607 FICO score won't have as much trouble getting loans as those with lower credit, ...

What does 607 mean when it comes to my credit score?

A 607 is considered a ‘fair’ credit score, which puts you in the middle range of scores among consumers. This score generally indicates that you are financially responsible and have manageable debt.

What kind of loans can I get with a 607 credit score?

With a score of 607, you should qualify for many different types of loans including auto loans, home equity loans, personal loans, student loans, etc. Depending on the lender's criteria, however, some may offer more favorable terms than others.

Is a 607 credit score enough to get approved?

Generally speaking, yes. While lenders often set their own criteria for approval when it comes to the specific details of the loan (such as amount or duration), having a 607 will make it easy for lenders to view your application favorably.

What can I do if I want to increase my 607 credit score?

To improve your 607 score there are several steps you can take such as paying down existing debt and making timely payments on all bills and accounts. Additionally, you may want to consider getting a secured or store card in order to build up positive payment history over time. Finally, reviewing your credit report can help you spot any errors that may need correction–doing so can help improve your overall score as well!

How long does it take for my credit scores to improve after taking action?

The time frame can vary depending on how quickly you take action and how much effort is put into it; usually changes typically take anywhere from three months up to one year or more before seeing significant improvements in your scores.

Conclusion:

Having a 607 Credit Score is definitely an advantage when seeking different types of financing opportunities; understanding what this score means as well as what steps one needs to take in order improve it are key elements in managing your finances responsibly over time.