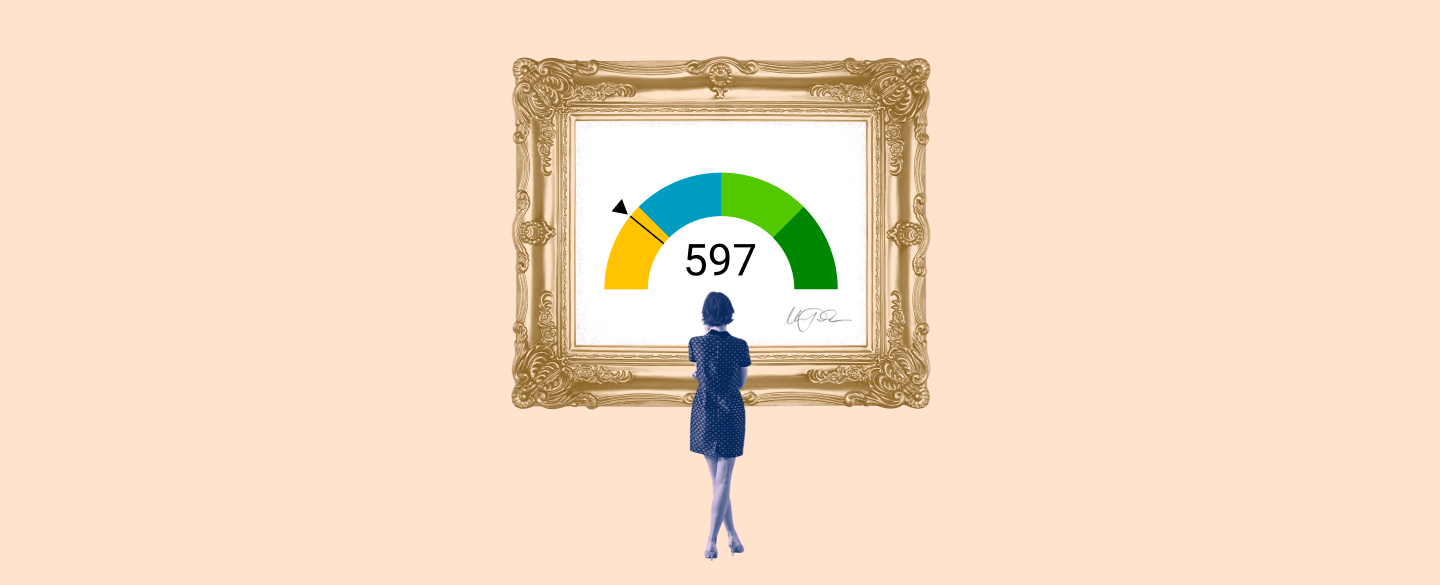

A FICO score of 597 is an estimate of your creditworthiness, based on the information in your credit report. It ranges from 300 to 850 and is used by lenders to decide if they should lend to you and at what interest rate. A FICO score of 597 falls into the “Fair” category, meaning it may not give you access to the best rates, but there are still plenty of borrowing options available.

Table Of Content:

- 597 Credit Score: Is it Good or Bad?

- 597 Credit Score: What Does It Mean? | Credit Karma

- Is 597 a Good Credit Score? Rating, Loans & How to Improve

- 597 Credit Score (+ #1 Way To Fix It )

- Can I get a car loan with a credit score of 597? | Jerry

- 597 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Is 597 a good credit score? | Lexington Law

- 597 Credit Score: Is it Good or Bad? (Approval Odds)

- 597 Credit Score – Is it Good or Bad? How to Improve Your 597 ...

- 597 Credit Score: Good or Bad? | Credit Card & Loan Options

1. 597 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/597-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 597 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 597 FICO® Score is below the average credit score.

2. 597 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/597 Apr 30, 2021 ... A 597 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 597 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 597 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/597-credit-score/

A credit score of 597 isn't “good.” It's not even “fair.” Rather, a 597 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. 597 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/597-credit-score

Jun 11, 2022 ... A 597 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 597 Credit Score. Lenders ...

5. Can I get a car loan with a credit score of 597? | Jerry

https://getjerry.com/questions/can-i-get-a-car-loan-with-a-credit-score-of-597![]() Feb 24, 2022 ... If you have a credit score of 597, you can expect your auto loan interest rates to fall somewhere between 9.92% and 15.91% on average.

Feb 24, 2022 ... If you have a credit score of 597, you can expect your auto loan interest rates to fall somewhere between 9.92% and 15.91% on average.

6. 597 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/597-credit-score-mortgage/

The most common type of loan available to borrowers with a 597 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, ...

7. Is 597 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/597 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

8. 597 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/597-credit-score/ Is 597 a good credit score? FICO scores range from 300 to 850. As you can see below, a 597 credit score is considered Fair.

Is 597 a good credit score? FICO scores range from 300 to 850. As you can see below, a 597 credit score is considered Fair.

9. 597 Credit Score – Is it Good or Bad? How to Improve Your 597 ...

https://www.creditrepairexpert.org/597-credit-score/ How to Improve Your 597 FICO Score. Before you can do anything to increase your 597 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 597 FICO Score. Before you can do anything to increase your 597 credit score, you need to identify what part of it needs to be improved, ...

10. 597 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/597/

Nov 9, 2021 ... 597 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

What range of FICO scores are there?

There are FICO scores between 300-850.

How do lenders use a FICO score?

Lenders use your FICO score to decide whether or not they should lend to you and at what interest rate.

What is considered a “Fair” FICO Score?

A “Fair”FICO Score is generally considered around 580-669.

Are there still borrowing options available with a FICO score of 597?

Yes, although it may not give you access to the best rates, there are still plenty of borrowing options available with a FICO score of 597.

Conclusion:

A FICO score of 597 is an indication that you may not have access to the best loan rates but there are still plenty of borrowing options available if you have a lower than average credit score. With some diligence and time, improving your credit score can improve your access to more competitive rates and terms in the future.