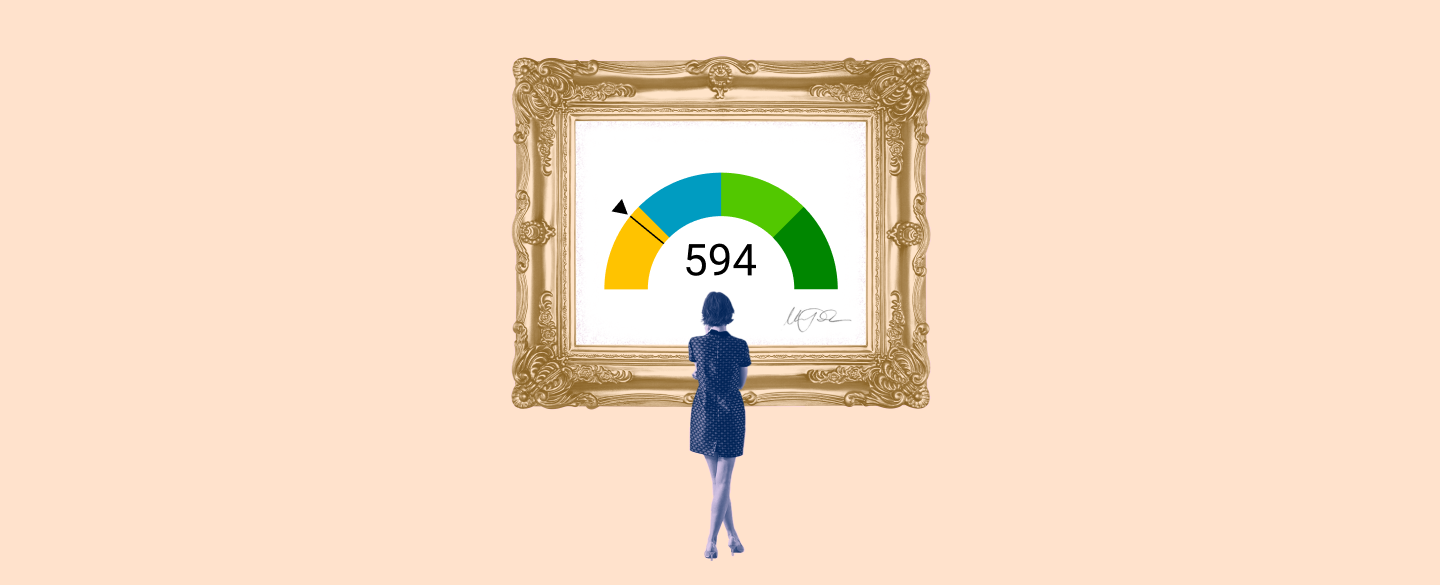

Do you have a credit score between 580 & 669? If so, you could be eligible for the 594 Credit Score Credit Card. This card can help you rebuild your credit and get back on the right financial track. It offers an impressive range of benefits, such as competitive low rates, access to a variety of rewards programs, and no fees on foreign transactions. With this card, you’ll be well on your way towards better credit scores and better financial health.

Table Of Content:

- Is 594 a Good Credit Score? Rating, Loans & How to Improve

- 594 Credit Score: Is it Good or Bad?

- 594 Credit Score: What Does It Mean? | Credit Karma

- Best credit cards for credit score under 599 (bad credit)

- 9 “Guaranteed Approval” Credit Cards for Bad Credit (2022)

- Best Credit Cards for Fair Credit - Credit Scores 580-669 – The ...

- 594 Credit Score (+ #1 Way To Fix It )

- 594 Credit Score: Good or Bad? | Credit Card & Loan Options

- Credit Cards for Fair Credit | Credit Cards to Build Credit | Capital One

- 594 Credit Score: Is it Good or Bad? (Approval Odds)

1. Is 594 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/594-credit-score/

Here are the best credit cards for a 594 credit score: ; Capital One Platinum Secured Credit Card image · Capital One Platinum Secured Credit Card ; OpenSky ...

2. 594 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/594-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 594 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 594 FICO® Score is below the average credit score.

3. 594 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/594 A 594 credit score can be a sign of past credit difficulties or a lack of credit history.

A 594 credit score can be a sign of past credit difficulties or a lack of credit history.

4. Best credit cards for credit score under 599 (bad credit)

https://www.moneyunder30.com/credit-cards/credit-score-under-599 May 31, 2022 ... The Petal® 1 “No Annual Fee” Visa® Credit Card is a great no-annual-fee card with a solid rewards system for people with limited or no credit.

May 31, 2022 ... The Petal® 1 “No Annual Fee” Visa® Credit Card is a great no-annual-fee card with a solid rewards system for people with limited or no credit.

5. 9 “Guaranteed Approval” Credit Cards for Bad Credit (2022)

https://www.cardrates.com/advice/guaranteed-approval-credit-cards/ May 16, 2022 ... 1. Capital One Platinum Secured Credit Card · 2. OpenSky® Secured Visa® Credit Card · 3. Secured Sable ONE Credit Card · 4. Indigo® Unsecured ...

May 16, 2022 ... 1. Capital One Platinum Secured Credit Card · 2. OpenSky® Secured Visa® Credit Card · 3. Secured Sable ONE Credit Card · 4. Indigo® Unsecured ...

6. Best Credit Cards for Fair Credit - Credit Scores 580-669 – The ...

https://www.doughroller.net/credit-cards/best-credit-cards-for-fair-credit/:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/RVP34K2GD5CNTNSJCDRGMHFMX4.jpg) Oct 12, 2021 ... Best Credit Cards for Credit Score 580 - 669 · Capital One QuicksilverOne Cash Rewards Credit Card · Jasper Cash Back Mastercard · Capital One ...

Oct 12, 2021 ... Best Credit Cards for Credit Score 580 - 669 · Capital One QuicksilverOne Cash Rewards Credit Card · Jasper Cash Back Mastercard · Capital One ...

7. 594 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/594-credit-score

8. 594 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/594/ Nov 9, 2021 ... 594 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high enough ...

Nov 9, 2021 ... 594 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high enough ...

9. Credit Cards for Fair Credit | Credit Cards to Build Credit | Capital One

https://www.capitalone.com/credit-cards/fair-and-building/ Explore Capital One credit cards for people who have fair credit and want to ... for Capital One credit card offers, with no impact to your credit score.

Explore Capital One credit cards for people who have fair credit and want to ... for Capital One credit card offers, with no impact to your credit score.

10. 594 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/594-credit-score/ Can I get a home loan with a credit score of 594? ... The minimum credit score is around 620 for most conventional lenders. However, for those interested in ...

Can I get a home loan with a credit score of 594? ... The minimum credit score is around 620 for most conventional lenders. However, for those interested in ...

What types of rewards are available with the 594 Credit Score Credit Card?

The 594 Credit Score Credit Card gives cardholders access to a variety of rewards programs including cash back, travel rewards, and discounts at select merchants. Earn up to 2% cash back on all purchases made with the card as well as bonus points when you use it for recurring bills or utilities. Plus, take advantage of exclusive discounts and offers from select retailers when you use your card to make purchases in-store or online.

Does the 594 Credit Score Credit Card have any foreign transaction fees?

No! The 594 Credit Score Credit Card does not charge any additional fees or charges on foreign transactions – making it one of the more affordable options for international travelers or shoppers seeking to make cross-border payments.

Are there any annual membership fees associated with this card?

No annual fee is required when using the 594 Credit Score Credit Card – making it ideal for those seeking to establish healthy spending habits without incurring additional costs or penalties each year.

Conclusion:

The 594 Credit Score Credit Card is an excellent option for those who want to build their credit but still enjoy the benefits of a secure and rewarding credit card experience. Enjoy low rates and no foreign transaction fees while accessing a wide variety of rewards programs designed to meet every lifestyle need. With so many features packed into one dynamic package, it’s easy to see why this is one of the most sought after cards among individuals with average credit scores.