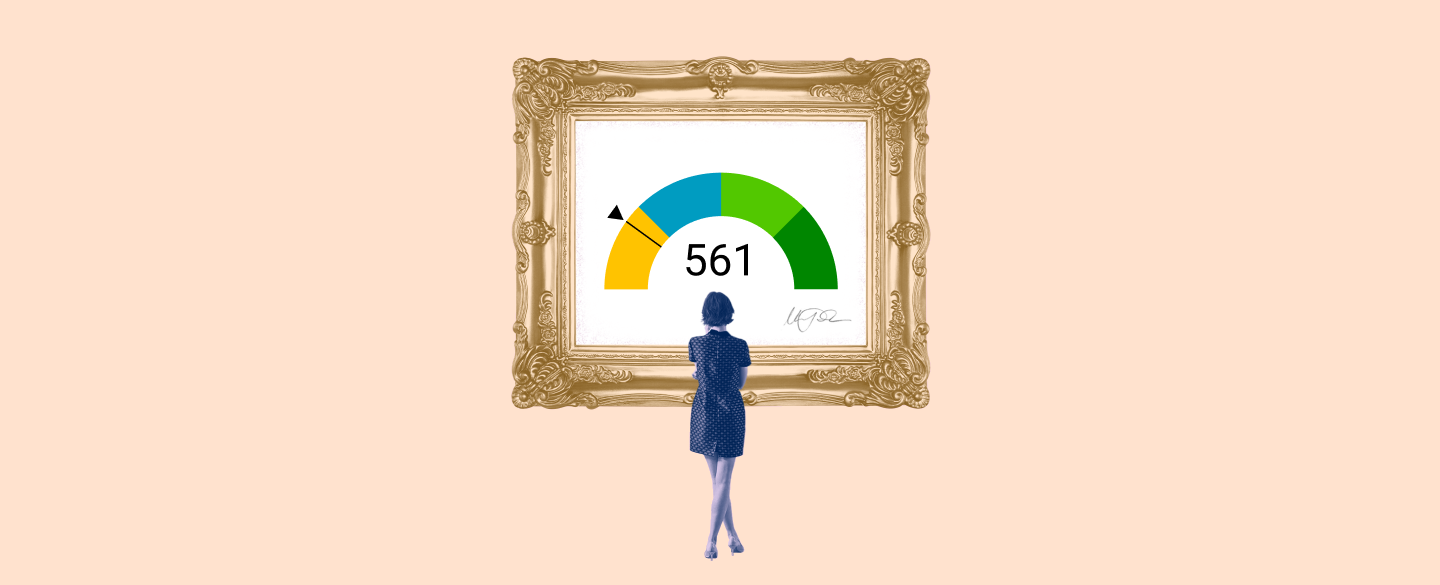

A credit score of 561 is considered a bad credit score, and it can indicate difficulty in obtaining loans or lines of credit. A low FICO score can cause an individual to be seen as a high-risk borrower. However, there are still available options for individuals with this type of credit.

Table Of Content:

- 561 Credit Score: Is it Good or Bad?

- 561 Credit Score: Good or Bad, Loan Options & Tips

- 561 Credit Score: Is it Good or Bad? How do I Improve it?

- 561 Credit Score: What Does It Mean? | Credit Karma

- 561 Credit Score (+ #1 Way To Fix It )

- Is 561 a good credit score? | Lexington Law

- 561 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 561 Credit Score Car Loan Top Sellers, 56% OFF | www ...

- 561 Credit Score: Good or Bad? | Credit Card & Loan Options

- 561 Credit Score: Is it Good or Bad? (Approval Odds)

1. 561 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/561-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 561 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 561 FICO® Score is significantly below the average credit score.

2. 561 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/561-credit-score/

A 561 credit score is classified as "bad" on the standard 300-to-850 scale. It is 139 points away from being a “good” credit score, which many people use as ...

3. 561 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/561-credit-score

A 561 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

4. 561 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/561 Apr 30, 2021 ... A 561 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 561 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

5. 561 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/561-credit-score

6. Is 561 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/561 Oct 11, 2021 ... A score under 580 (such as 561 ) usually falls into the “very poor” category. Having a 561 score likely means you've had a history of poor ...

Oct 11, 2021 ... A score under 580 (such as 561 ) usually falls into the “very poor” category. Having a 561 score likely means you've had a history of poor ...

7. 561 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/561-credit-score-mortgage/

Frequently Asked Questions ... Can I get a conventional loan with a 561 credit score? No, the minimum credit score required for a conventional loan is a 620. Can ...

8. 561 Credit Score Car Loan Top Sellers, 56% OFF | www ...

https://www.ingeniovirtual.com/page/6/?p=6.40.5512368.4.29.84.561+credit+score+car+loan![]() Shop the cheapest selection of 561 credit score car loan, 56% Discount Last 5 Days. best cheap car seats, best baby nail clippers, step 2 push car green, ...

Shop the cheapest selection of 561 credit score car loan, 56% Discount Last 5 Days. best cheap car seats, best baby nail clippers, step 2 push car green, ...

9. 561 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/561/ Nov 8, 2021 ... 561 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a ...

Nov 8, 2021 ... 561 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a ...

10. 561 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/561-credit-score/ Is 561 a good credit score? FICO scores range from 300 to 850. As you can see below, a 561 credit score is considered Poor.

Is 561 a good credit score? FICO scores range from 300 to 850. As you can see below, a 561 credit score is considered Poor.

What measures can I take to improve my 561 credit score?

Improving your 561 credit score may take time, but there are steps that you can take to help rebuild your credit history and improve your score over time. Paying down debt balances, keeping accounts open and in good standing, and making consistent on-time payments are all strategies you can use to start improving your credit score.

What other types of financial products are available with a 561 credit score?

Borrowers with a lower FICO rating such as a 561 may have more difficulty accessing conventional financing products such as personal loans. However, those with this type of credit may still qualify for secured loans where collateral is used to cover the risk or subprime auto loans from non-traditional lenders in order to purchase a vehicle.

Are there any steps I should take before applying for financing?

Before applying for any type of loan or line of credit it is important to review your overall financial situation including any outstanding debts, savings, and assets. You should also obtain copies of your latest credit reports from TransUnion, Equifax and Experian to assess what areas need improvement before starting the process of applying for financing. It’s also important to review how different types of loans work so that you understand how interest rates, fees and repayment terms apply when making borrowing decisions.

How else might my 561 credit score affect me?

Along with making it difficult for people with bad credit scores such as 561 to obtain financing, having poor credit history can also make it harder for individuals find employment because some employers check applicants’ scores during the hiring process. Additionally, landlords may ask for proof of acceptable scores when signing leases or renewing them; otherwise they may require higher security deposits than people with better ratings would have to pay. Furthermore, insurance companies often use an applicant's FICO rating when calculating rates; as such someone with bad credits scores like 561 could end up paying higher premiums than those who have better scores.

When should I consider using services from a professional Credit Score repair organization?

If after assessing your current financial situation and taking steps independently you’re still unable to improve your FICO rating then considering enlisting help from professionals who specialize in repairing bad credits could be beneficial in getting back on track sooner rather than later. They offer assistance such as helping remove outdated negative items off reports which can help boost overall points quickly when done properly so if this is something you feel will benefit you then seeking out their services might be worth looking into further.

Conclusion:

With careful planning and diligence it’s possible for those who are stuck at a 561credit score level to begin rebuilding their finances back towards good standing over time by taking advantage of available options such as personal debt counseling services or by creating budget plans that fit their goals best without creating additional stress or further harm their existing reputation.