A credit score is a three-digit number used to determine the likelihood you will repay a loan as agreed. Naturally, the higher your score, the better off you are in the eyes of creditors. A FICO score of 555, while not ideal, could provide enough wiggle room for some to borrow — with diligence and perseverance.

Table Of Content:

- 555 Credit Score: Is it Good or Bad?

- 555 Credit Score: Good or Bad, Loan Options & Tips

- 555 Credit Score: Is it Good or Bad? How do I Improve it?

- 555 Credit Score: What Does It Mean? | Credit Karma

- 555 Credit Score (+ #1 Way To Fix It )

- 555 Credit Score: Is it Good or Bad? (Approval Odds)

- Credit Score of 555: Home Loans, Auto Loans & Credit Cards - Go ...

- Is 555 a good credit score? | Lexington Law

- Low Credit Score FHA Home Buyers Might Qualify in 2022

- What is a good or average credit score? | Barclaycard

1. 555 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/555-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 555 FICO® Score is significantly below the average credit score. Many ...

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 555 FICO® Score is significantly below the average credit score. Many ...

2. 555 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/555-credit-score/

A 555 credit score is classified as "bad" on the standard 300-to-850 scale. It is 145 points away from being a “good” credit score, which many people use as ...

3. 555 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/555-credit-score

A 555 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

4. 555 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/555 You might have a hard time getting approved for a credit card with poor credit scores. The good news is, Credit Karma can ...

You might have a hard time getting approved for a credit card with poor credit scores. The good news is, Credit Karma can ...

5. 555 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/555-credit-score

Jun 11, 2022 ... Is 555 a Good Credit Score? ... A 555 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

6. 555 Credit Score: Is it Good or Bad? (Approval Odds)

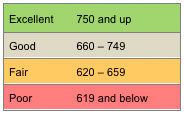

https://www.crediful.com/fico-credit-score-range/555-credit-score/ Is 555 a good credit score? FICO scores range from 300 to 850. As you can see below, a 555 credit score is considered Poor.

Is 555 a good credit score? FICO scores range from 300 to 850. As you can see below, a 555 credit score is considered Poor.

7. Credit Score of 555: Home Loans, Auto Loans & Credit Cards - Go ...

https://gocleancredit.com/credit-score-of-555-home-loans-auto-loans-credit-cards/ Is a credit score of 555 good or bad? What does a credit score of 555 mean? score-chart. Brace yourself for some bad news… If you ...

Is a credit score of 555 good or bad? What does a credit score of 555 mean? score-chart. Brace yourself for some bad news… If you ...

8. Is 555 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/555 Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 555 ) ...

Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 555 ) ...

9. Low Credit Score FHA Home Buyers Might Qualify in 2022

https://mymortgageinsider.com/new-fha-policy-for-low-credit-home-buyers-7494/

May 25, 2022 ... It doesn't seem to make a lot of sense until you realize that FHA penalizes lenders for approving too many bad FHA loans. Statistically, ...

10. What is a good or average credit score? | Barclaycard

https://www.barclaycard.co.uk/personal/money-matters/credit-score-basics/what-is-a-good-or-average-credit-score Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency (CRA) uses a ...

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency (CRA) uses a ...

What is a credit score?

A credit score is a three-digit number that measures the likelihood you will repay loans granted to you by creditors. It is calculated based on your financial history, such as how much debt you have and how reliably you pay it back.

What is considered a good credit score?

Generally, lenders view scores of 700 or higher as excellent, while those below 600 may be seen as subprime borrowers with increased risk of defaulting on loans they receive from lenders. Scores between 600 and 699 are typically considered to be fair or average.

How can I improve my credit score?

The most important steps to improving your credit score include paying bills on time and keeping balances low on credit cards and other revolving credit accounts. Additionally, it may help to keep old accounts open even if they’re inactive; many scoring models reward having an older account history.

Does a low credit score disqualify me from getting a loan?

Not necessarily – although it might make qualifying for some types of financing more difficult than others. If you have a lower than average credit score like 555 then the interest rates offered might be higher than those offered to someone with an excellent rating.

Are there options for people with bad or poor FICO Score?

Yes! Even if your FICO Score falls into "bad" territory (below 560), there are still lending options available such as secured loans and personal lines of credit offered by online lenders. With these options, it may take longer to qualify for larger amounts but it can be done!

Conclusion:

In general, when evaluating one's ability to make payments on their debts responsibly, having good or excellent credit scores will always have advantages when seeking out new financing opportunities; however, there are circumstances where those with lower FICO scores can also qualify for loans depending on their unique situation. Having a low FICO Score doesn't necessarily mean that one cannot secure financing—there may just need to be more scrutiny and paperwork involved in certain cases depending on each lender's individual underwriting guidelines.