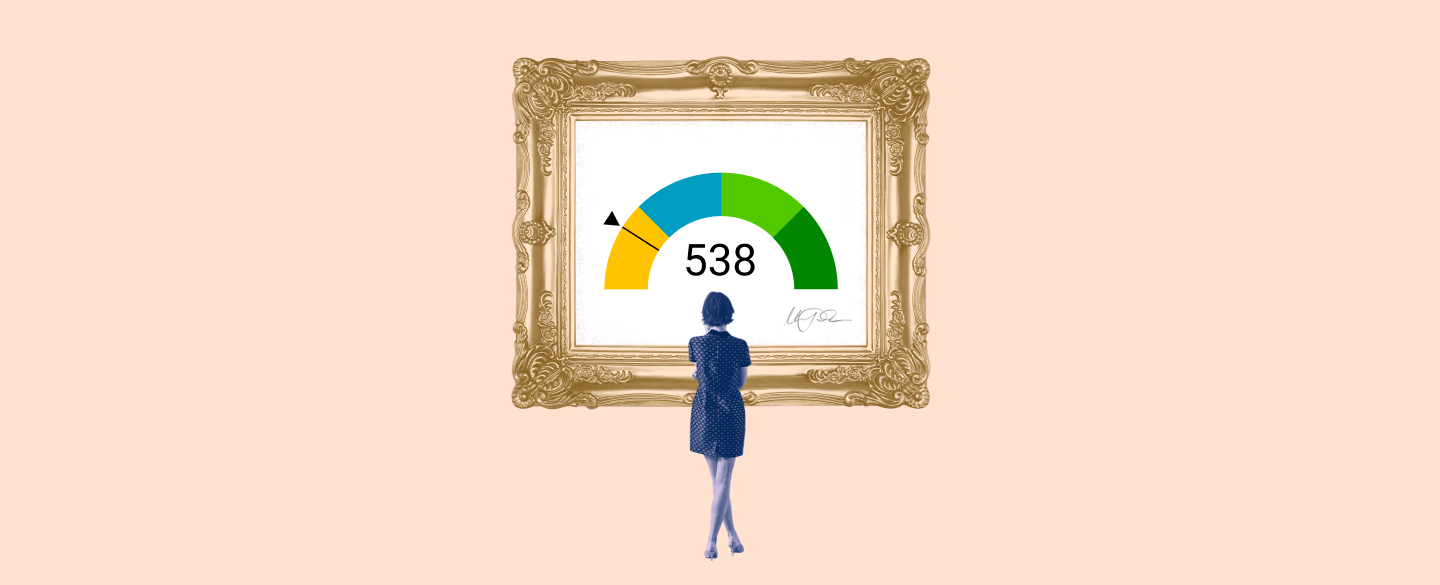

The 538 Credit Score Mortgage is an innovative loan solution designed to help those with lower-than-average credit scores get the financing they need. This unique program gives borrowers access to mortgage loans even if they aren’t able to qualify for traditional lenders’ loans due to their credit score. With this program, you can receive up to $3.5 million in funds without a down payment or standard origination fees!

Table Of Content:

- 538 Credit Score: Good or Bad, Loan Options & Tips

- 538 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 538 Credit Score: What Does It Mean? | Credit Karma

- Is 538 a good credit score? | Lexington Law

- 538 Credit Score (+ #1 Way To Fix It )

- 538 Credit Score: Is it Good or Bad?

- 538 Credit Score: Is it Good or Bad? How do I Improve it?

- Best Personal Loans for 538 Credit Score - CreditScoreGeek

- Low Credit Score FHA Home Buyers Might Qualify in 2022

- 538 Credit Score: Is it Good or Bad? (Approval Odds)

1. 538 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/538-credit-score/

Credit cards and auto loans offer the best approval odds for someone with a 538 credit score. For example, people with credit scores below 580 take out roughly ...

2. 538 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/538-credit-score-mortgage/

Frequently Asked Questions ... Can I get a conventional loan with a 538 credit score? No, the minimum credit score required for a conventional loan is a 620. Can ...

3. 538 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/538 A 538 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for ...

A 538 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for ...

4. Is 538 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/538 Oct 11, 2021 ... It won't be easy to get approved for a car loan with a credit score of 538. If you are approved, it may be at an extremely high interest rate ...

Oct 11, 2021 ... It won't be easy to get approved for a car loan with a credit score of 538. If you are approved, it may be at an extremely high interest rate ...

5. 538 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/538-credit-score

6. 538 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/538-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 538 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 538 FICO® Score is significantly below the average credit score.

7. 538 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/538-credit-score

A 538 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

8. Best Personal Loans for 538 Credit Score - CreditScoreGeek

https://creditscoregeek.com/bad-credit/538/personal-loan/ People with 538 credit score can easily access Payday loans without having to worry about their credit and that is why some people feel is a more viable option ...

People with 538 credit score can easily access Payday loans without having to worry about their credit and that is why some people feel is a more viable option ...

9. Low Credit Score FHA Home Buyers Might Qualify in 2022

https://mymortgageinsider.com/new-fha-policy-for-low-credit-home-buyers-7494/

May 25, 2022 ... This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA. Loan ...

10. 538 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/538-credit-score/ Many lenders choose not to lend to borrowers with credit scores in the Poor range. As a result, your ability to borrow money and financing options are going to ...

Many lenders choose not to lend to borrowers with credit scores in the Poor range. As a result, your ability to borrow money and financing options are going to ...

What is the minimum credit score I have to have?

The 538 Credit Score Mortgage requires a minimum FICO score of at least 538, but some lenders may require higher scores depending on the loan amount and other factors.

How long will it take for me to get approved?

Approval decisions usually occur within a few days. However, the time frame can vary based on the complexity of the application and the number of documents that need to be reviewed.

Are there any restrictions on where I can use this loan?

No, you can use your 538 Credit Score Mortgage funds anywhere in the US!

Conclusion:

The 538 Credit Score Mortgage is a great option for those who have been turned down by traditional lenders due to their credit score. With this program, you can receive up to $3.5 million in funding without having to worry about making a large down payment or high origination fees. Plus, approval decisions are usually made quickly so you can get your money fast!