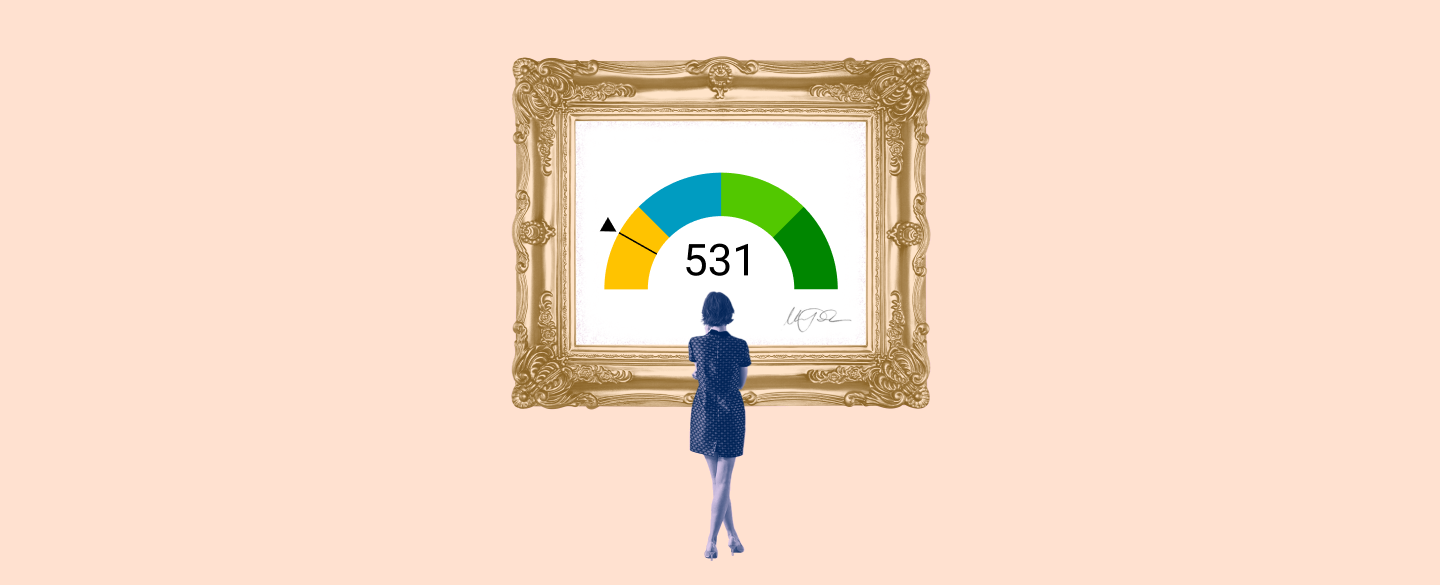

A 531 credit score credit card is a type of financial instrument designed to help people who have lower credit scores access the same financial benefits and services that those with higher scores can. These cards are ideal for individuals whose scores fall within the 500-599 range, as it enables them to gain access to a variety of features such as travel rewards and signup bonuses. With these cards, individuals can rebuild their credit rating, establish financial security, and enjoy the convenience of plastic payment.

Table Of Content:

- 531 Credit Score: Good or Bad, Loan Options & Tips

- 531 Credit Score: Good or Bad? | Credit Card & Loan Options

- 531 Credit Score: What Does It Mean? | Credit Karma

- 531 Credit Score: Is it Good or Bad?

- 8 Best Loans & Credit Cards (500 to 550 Credit Score) - 2022

- 5 Best Credit Cards For Credit Scores Of 580 Or Below

- 531 Credit Score (+ #1 Way To Fix It )

- Corporate Cards from American Express

- Credit Cards for Fair Credit | Credit Cards to Build Credit | Capital One

- 531 Credit Score: Is it Good or Bad? How do I Improve it?

1. 531 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/531-credit-score/

Credit Cards for a 531 Credit Score ; OpenSky Secured Visa Credit Card image · OpenSky® Secured Visa® Credit Card ; Credit One Bank Platinum Visa image · Credit One ...

2. 531 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/531/ Nov 8, 2021 ... 531 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a mortgage ...

Nov 8, 2021 ... 531 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a mortgage ...

3. 531 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/531 May 4, 2021 ... A 531 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 4, 2021 ... A 531 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. 531 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/531-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 531 FICO® Score is significantly below the average credit score. Many ...

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 531 FICO® Score is significantly below the average credit score. Many ...

5. 8 Best Loans & Credit Cards (500 to 550 Credit Score) - 2022

https://www.cardrates.com/advice/500-to-550-credit-score/ Sep 15, 2021 ... 8 Best Loans & Credit Cards for a 500 to 550 Credit Score ; 1. Surge Mastercard®. Surge Mastercard® Review · Apply Now ; Capital One Platinum ...

Sep 15, 2021 ... 8 Best Loans & Credit Cards for a 500 to 550 Credit Score ; 1. Surge Mastercard®. Surge Mastercard® Review · Apply Now ; Capital One Platinum ...

6. 5 Best Credit Cards For Credit Scores Of 580 Or Below

https://www.cnbc.com/select/best-credit-cards-for-credit-scores-of-580-and-below/ Jul 1, 2022 ... While credit card options for consumers with lower credit scores can be slim, there are still several options worth considering.

Jul 1, 2022 ... While credit card options for consumers with lower credit scores can be slim, there are still several options worth considering.

7. 531 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/531-credit-score

8. Corporate Cards from American Express

https://www.americanexpress.com/us/credit-cards/business/corporate-credit-cards Give us a call to get a program tailored to your company's needs.855-531-3491. Corporate Credit Cards From American Express ...

Give us a call to get a program tailored to your company's needs.855-531-3491. Corporate Credit Cards From American Express ...

9. Credit Cards for Fair Credit | Credit Cards to Build Credit | Capital One

https://www.capitalone.com/credit-cards/fair-and-building/ Explore Capital One credit cards for people who have fair credit and want to ... for Capital One credit card offers, with no impact to your credit score.

Explore Capital One credit cards for people who have fair credit and want to ... for Capital One credit card offers, with no impact to your credit score.

10. 531 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/531-credit-score

A 531 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

What types of features do 531 Credit Score Credit Cards offer?

531 Credit Score Credit Cards generally offer the same features as other credit cards including travel rewards, signup bonuses, cash back options, low introductory APR rates, fraud protection services, and other rewards programs. Depending on the specific card offered, some may also include additional features such as balance transfers and online banking services.

How does having a 531 Credit Score Card help rebuild my credit rating?

With responsible management of your 531 Credit Score Card account, you can improve your overall credit score over time by making regular payments on time. As your account becomes older and more established with a bank or lender, it can demonstrate to potential lenders that you are capable of managing debt responsibly. Ultimately this will result in improved access to better rates on future loans or increased borrowing power.

Are there any special fees associated with 531 Credit Score Cards?

Generally speaking most 531 Credit Score Cards require an Annual Percentage Rate (APR) along with annual fees and other miscellaneous charges associated with each transaction made. However these fees tend to be less than those charged by high-end credit cards due to the lower risk involved for banks and lenders when providing them to customers with lower scores.

Conclusion:

A 531 Credit Score Card can provide individuals with an opportunity to gain access to financial benefits despite having a lower score then those typically accepted by traditional lenders. The ability to manage debt responsibly will allow holders of these types of cards the ability to improve their overall rating while receiving solid perks from various offer packages available through banks and lenders worldwide.