The 489 credit score car loan is an excellent option for individuals with poor credit. With this loan, those with a lower credit rating can still get the vehicle they need. This loan makes it possible to shop for and purchase a car without having to wait to save up and pay cash. Best of all, it's easy to apply and often times you can get approved within 24 hours!

Table Of Content:

- 489 Credit Score: Borrowing Options & How to Fix

- 489 Credit Score: Is it Good or Bad?

- 489 Credit Score: What Does It Mean? | Credit Karma

- Is 489 a good credit score? | Lexington Law

- Car loan interest rates with 489 credit score in 2022

- Will a 490 credit score get me an auto loan with no money down ...

- 489 Credit Score: Good or Bad? | Credit Card & Loan Options

- 489 Credit Score: Is it Good or Bad? How do I Improve it?

- 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

- Do I Need a Specific Credit Score to Buy a Car? | Navy Federal ...

1. 489 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/489-credit-score/

And that signals risk to potential lenders. As a result, a 489 credit score will make it difficult to qualify for a loan or unsecured credit card. And you will ...

2. 489 Credit Score: Is it Good or Bad?

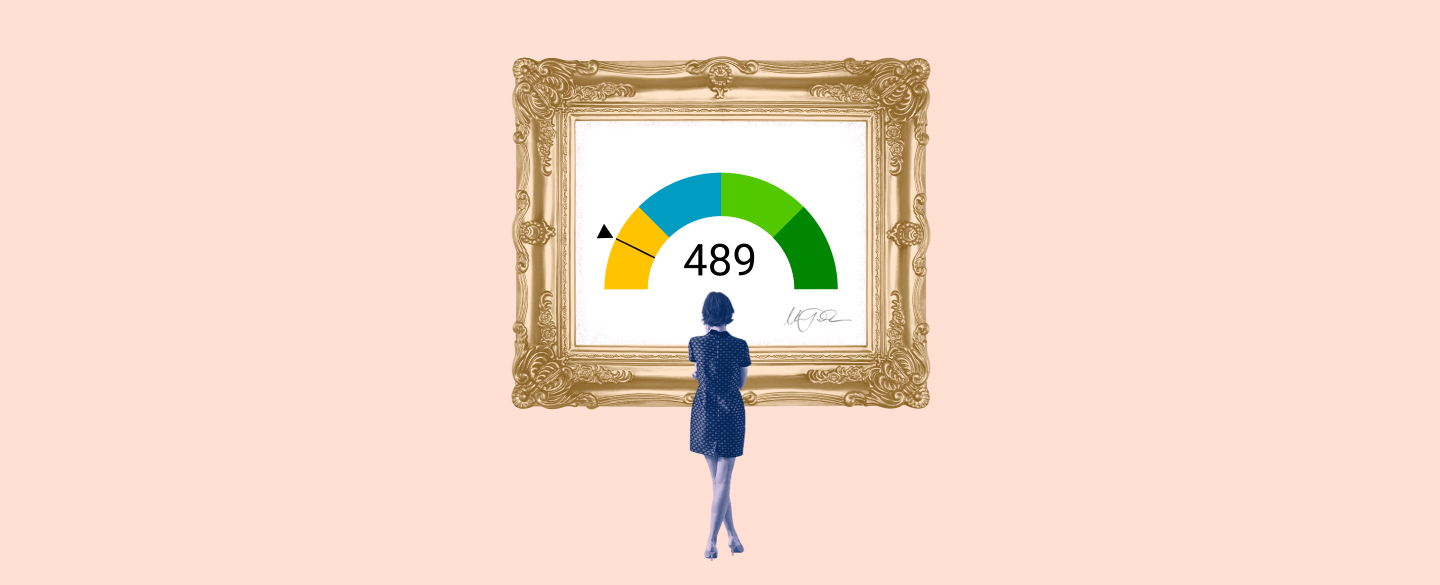

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/489-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 489 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 489 FICO® Score is significantly below the average credit score.

3. 489 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/489 There's no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, ...

There's no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, ...

4. Is 489 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/489 Oct 11, 2021 ... It won't be easy to get approved for a car loan with a credit score of 489. If you are approved, it may be at an extremely high interest rate ...

Oct 11, 2021 ... It won't be easy to get approved for a car loan with a credit score of 489. If you are approved, it may be at an extremely high interest rate ...

5. Car loan interest rates with 489 credit score in 2022

https://creditscoregeek.com/bad-credit/489/auto/ Those with 489 score tend to have the most problems when applying and trying to obtain a vehicle loan. It does not matter the type or price of the vehicle they' ...

Those with 489 score tend to have the most problems when applying and trying to obtain a vehicle loan. It does not matter the type or price of the vehicle they' ...

6. Will a 490 credit score get me an auto loan with no money down ...

https://www.compareauto.loan/credit-scores/will-a-490-credit-score-get-me-an-auto-loan

Experian stated that vehicle loans for people with scores of under 490 characterized 20% of auto loans in 2019! Check down the page for car loans that might ...

7. 489 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/489/ Feb 18, 2022 ... 489 is a bad credit score. It's rated as either “poor” or “very poor” by every major credit scoring model. Scores in this range make it ...

Feb 18, 2022 ... 489 is a bad credit score. It's rated as either “poor” or “very poor” by every major credit scoring model. Scores in this range make it ...

8. 489 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/489-credit-score

A 489 credit score is a poor credit score. ... As of December 9th, 2020, the bank estimated an interest rate of 3.39% for a car loan (2020 Ford) to ...

9. 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

https://www.badcredit.org/how-to/loans-credit-cards-for-400-to-450-credit-score/ : 400-450 Credit Score. Auto loans are a type of installment loan, though they differ from personal loans in a few ways.

: 400-450 Credit Score. Auto loans are a type of installment loan, though they differ from personal loans in a few ways.

10. Do I Need a Specific Credit Score to Buy a Car? | Navy Federal ...

https://www.navyfederal.org/resources/articles/auto-loans/credit-score-to-buy-a-car.html What influences your auto loan's interest rate the most is your credit score. Although not all credit scores are calculated in exactly the same way, ...

What influences your auto loan's interest rate the most is your credit score. Although not all credit scores are calculated in exactly the same way, ...

What are the requirements to qualify for 489 credit score car loan?

The main requirement is to have a 489 or higher FICO score. Generally lenders also require proof of income, residence and bank account information.

Are there any other eligibility requirements?

Yes, lenders will also consider your debt-to-income ratio and employment status when determining your eligibility. Your overall financial profile is taken into consideration when applying for a car loan.

How much interest will I pay on a 489 credit score car loan?

Interest rates depend on several factors including the age of the vehicle, amount borrowed, length of repayment period and your current credit situation. Generally borrowers with a 489 credit score can expect interest rates between 10-15%.

Is it possible to get better terms in the future?

Yes, if you manage your payments responsibly and keep up-to-date with payments, you may be able to refinance in the future for better terms on the same loan or even qualify for new loans at more favorable rates in the future.

How long does it take to get approved?

It usually takes same day approval depending on your lender but some may require additional documents which can take longer than others. On average most applicants should receive their approval within 24 hours.

Conclusion:

The 489 credit score car loan is a great option for those looking for an affordable alternative when buying their next vehicle. This loan offers competitive interest rates fixed over the life of your loan along with shorter term lengths if necessary; making owning a car easier than ever before!