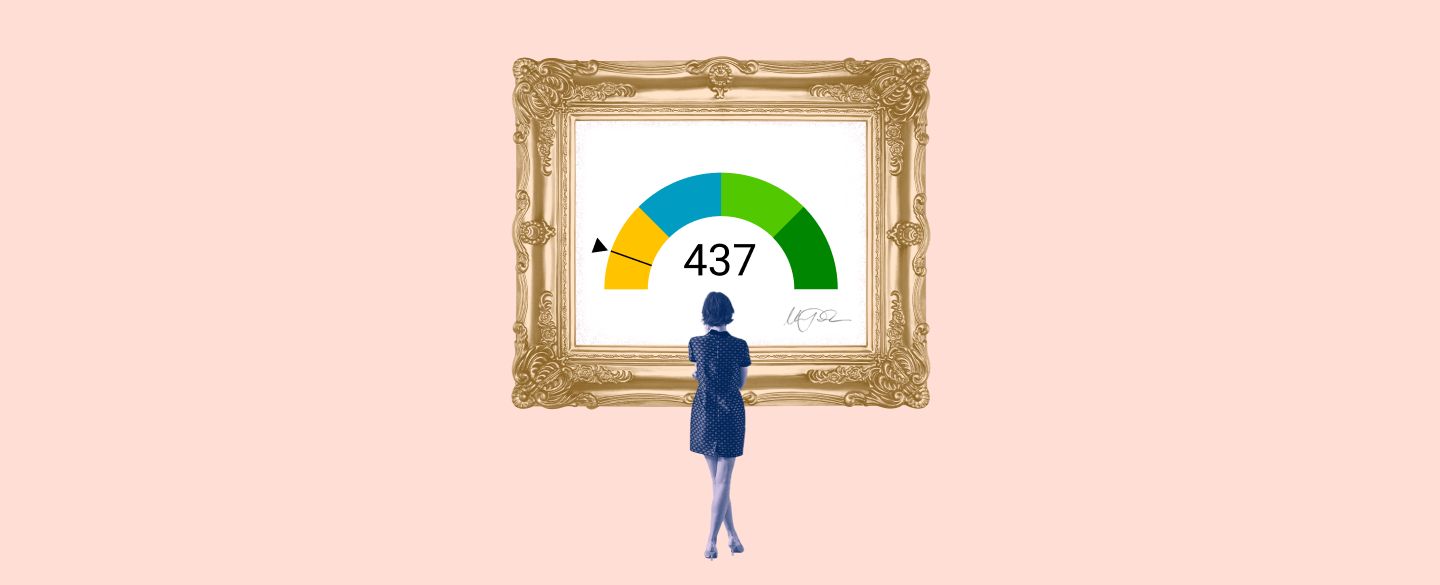

Credit scores are a numerical value used to determine how responsible an individual is with their finances. A 437 credit score is a score given by credit reporting bureaus like TransUnion, Experian and Equifax to assess your financial health. This score can range anywhere from 300-850, where the higher the number, the better. A 437 credit score indicates that you have had difficulty in making consistent payments on your debts, or have not had any experience with credit yet; either way this is not an ideal score and can make it difficult for you to take out loans or receive a favorable rate if you do take on debt.

Table Of Content:

- 437 Credit Score: Is it Good or Bad?

- 437 Credit Score: Borrowing Options & How to Fix

- 437 Credit Score: Is it Good or Bad? How do I Improve it?

- 437 Credit Score: What Does It Mean? | Credit Karma

- 437 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- Car loan interest rates with 437 credit score in 2022

- 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

- Best Personal Loans for 437 Credit Score - CreditScoreGeek

- Poster: A Scoping Review of Alternative Credit Scoring Literature ...

- Highland Falls, NY Branch | Navy Federal Credit Union

1. 437 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/437-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 437 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 437 FICO® Score is significantly below the average credit score.

2. 437 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/437-credit-score/

A 437 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

3. 437 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/437-credit-score

A 437 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

4. 437 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/437 Apr 30, 2021 ... A 437 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 437 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

5. 437 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/437-credit-score/ A credit score under 437 is considered a very “bad” credit score. If your credit score is this low, you'll more than likely have a very hard time obtaining ...

A credit score under 437 is considered a very “bad” credit score. If your credit score is this low, you'll more than likely have a very hard time obtaining ...

6. Car loan interest rates with 437 credit score in 2022

https://creditscoregeek.com/bad-credit/437/auto/ Find out what auto loan rates your 437 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 437.

Find out what auto loan rates your 437 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 437.

7. 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

https://www.badcredit.org/how-to/loans-credit-cards-for-400-to-450-credit-score/ Consumers with very poor credit scores between 400 and 450 often have their ... 436, 437, 438, 439, 440, 441, 442, 443, 444, 445, 446, 447, 448, 449, 450 ...

Consumers with very poor credit scores between 400 and 450 often have their ... 436, 437, 438, 439, 440, 441, 442, 443, 444, 445, 446, 447, 448, 449, 450 ...

8. Best Personal Loans for 437 Credit Score - CreditScoreGeek

https://creditscoregeek.com/bad-credit/437/personal-loan/ Find out the best personal loan options you can get for 437 credit score in 2022. Follow this advice to find the best personal loan for the FICO score under ...

Find out the best personal loan options you can get for 437 credit score in 2022. Follow this advice to find the best personal loan for the FICO score under ...

9. Poster: A Scoping Review of Alternative Credit Scoring Literature ...

https://dl.acm.org/doi/abs/10.1145/3460112.3471972 Sep 23, 2021 ... ... SocietiesJune 2021 Pages 437–444https://doi.org/10.1145/3460112.3471972 ... Credit scoring through data mining approach: A case study of ...

Sep 23, 2021 ... ... SocietiesJune 2021 Pages 437–444https://doi.org/10.1145/3460112.3471972 ... Credit scoring through data mining approach: A case study of ...

10. Highland Falls, NY Branch | Navy Federal Credit Union

https://www.navyfederal.org/branches-atms/locations/usa/ny/highland-falls/wst.html Branch Information. Stop By for Personal Service. Address. Located near West Point Academy, along Main Street in Highland Falls. 437 Main St Highland ...

Branch Information. Stop By for Personal Service. Address. Located near West Point Academy, along Main Street in Highland Falls. 437 Main St Highland ...

What does a 437 credit score mean?

A 437 credit score means that you have some difficulty making regular payments on debts or have had no experience in taking on debt – indicating that you are not financially responsible with your money.

Can I get a loan with a 437 credit score?

You may be able to get a loan with a 437 credit score; however, it will likely come with unfavorable terms such as high interest rates and possibly require collateral or co-signer for approval.

How can I improve my 437 credit score?

To improve your 437 credit score, paying off any existing debt obligations should be your first priority. Additionally, making timely payments towards all other monthly expenses such as utilities and rent are also important steps in rebuilding your creditworthiness. Finally, opening up one new line of credit such as a low limit secured card can help jump start the process of improving your overallscore.

How long will it take to raise my 437credit score?

The amount of time it takes to improve your 437creditscore depends upon many factors such as how much debt you have incurred and what payment history has been reported thus far. That being said,improvements can be seen fairly quickly when consistently applying good financial habits over the course of months rather than years.

What kind of interest rates can I expect with my existing 437creditScore?

Witha 437creditScore, lenders typically offer very high interestrates due to the risk involved in lending someone money who has not proven themselves to be reliable with their finances.

Conclusion:

Credit scores provide lenders and creditors insight into how responsible an individual is when managing theirmoney; however, depending on past financial actions or inexperience one’s current number may suffer greatly. A low credit score of 437 isn’t ideal but through consistent effort it is possible to rebuild and ultimately raise these numbers back up to meet what's considered “good."