Have you been thinking of buying a home in the beautiful state of Alabama? Well, if your dream is to own a home but you need some extra help with financing, then a 203k loan might be just what you need. A 203K loan is an FHA-approved loan designed specifically for people looking to finance and renovate homes. With this type of loan, you can not only purchase and improve your dream home but also potentially get better terms and lower interest rates than traditional mortgage loans.

Table Of Content:

- 203(k) Rehab Mortgage Insurance | HUD.gov / U.S. Department of ...

- Alabama FHA Lenders - Alabama FHA Loan Requirements 2022

- FHA 203K - Buy a Home in AL or FL | United Mortgage Group

- Alabama - FHA 203k Loan Lender

- FHA 203K Loan Lenders in Alabama (AL)

- 5 Best FHA 203(k) Mortgage Lenders - NerdWallet

- Alabama FHA 203k Loan - FHA 203k Mortgage

- FHA 203(k) Loan: Renovation Mortgage Guidelines - NerdWallet

- FHA Mortgage Limits

- FHA loan calculator: Check your FHA mortgage payment

1. 203(k) Rehab Mortgage Insurance | HUD.gov / U.S. Department of ...

https://www.hud.gov/program_offices/housing/sfh/203k/203k--df

Eligible Activities: ... Section 203(k) insured loans can finance the rehabilitation of the residential portion of a property that also has non-residential uses; ...

2. Alabama FHA Lenders - Alabama FHA Loan Requirements 2022

https://fhalenders.com/alabama-fha-lenders/ FHA 203k loans are a great program which will allow you to borrow the money needed to purchase the home plus additional funds needed to rehabilitate or remodel ...

FHA 203k loans are a great program which will allow you to borrow the money needed to purchase the home plus additional funds needed to rehabilitate or remodel ...

3. FHA 203K - Buy a Home in AL or FL | United Mortgage Group

https://unitedmortgageloans.com/203k-loans/ An FHA 203K loan is a loan backed by the federal government and given to buyers who want to renovate a home. An FHA 203K loan allows the borrower to finance the ...

An FHA 203K loan is a loan backed by the federal government and given to buyers who want to renovate a home. An FHA 203K loan allows the borrower to finance the ...

4. Alabama - FHA 203k Loan Lender

https://203kmortgagelender.com/203k-lenders-alabama/ Dustin Swigart is an FHA 203k Lender helping homebuyers, homeowners and real estate agents with their Renovation Loan financing throughout the California ...

Dustin Swigart is an FHA 203k Lender helping homebuyers, homeowners and real estate agents with their Renovation Loan financing throughout the California ...

5. FHA 203K Loan Lenders in Alabama (AL)

https://203klenders.org/alabama-al/ FHA Approved 203K Lenders in Alabama (AL) ; Everett Financial Inc · 1530 E Glenn Ave Ste E · Auburn, AL - 36830 · (334) 707-1703 (972) 380-3997 ; Hometrust Mortgage ...

FHA Approved 203K Lenders in Alabama (AL) ; Everett Financial Inc · 1530 E Glenn Ave Ste E · Auburn, AL - 36830 · (334) 707-1703 (972) 380-3997 ; Hometrust Mortgage ...

6. 5 Best FHA 203(k) Mortgage Lenders - NerdWallet

https://www.nerdwallet.com/best/mortgages/fha-203k-lenders Apr 4, 2022 ... NerdWallet's Best FHA 203(k) Mortgage Lenders · Fairway Independent Mortgage: Best for first-time home buyers · Guild Mortgage: Best for digital ...

Apr 4, 2022 ... NerdWallet's Best FHA 203(k) Mortgage Lenders · Fairway Independent Mortgage: Best for first-time home buyers · Guild Mortgage: Best for digital ...

7. Alabama FHA 203k Loan - FHA 203k Mortgage

http://fha203kmortgage.com/alabama-fha-203k-loan/ What exactly is an Alabama FHA 203k loan? ... The FHA 203k mortgage is a rehabilitation loan that works much like a development loan. The buyer of the home is ...

What exactly is an Alabama FHA 203k loan? ... The FHA 203k mortgage is a rehabilitation loan that works much like a development loan. The buyer of the home is ...

8. FHA 203(k) Loan: Renovation Mortgage Guidelines - NerdWallet

https://www.nerdwallet.com/article/mortgages/fha-203k-renovation-loan An FHA 203(k) loan allows you to buy or refinance a home that needs work and roll the renovation costs into the mortgage. You'll get a loan that covers both ...

An FHA 203(k) loan allows you to buy or refinance a home that needs work and roll the renovation costs into the mortgage. You'll get a loan that covers both ...

9. FHA Mortgage Limits

https://entp.hud.gov/idapp/html/hicostlook.cfm

Those are the median price estimates used for loan limit determination. They are for the high-price county within each defined metropolitan area, and for the ...

10. FHA loan calculator: Check your FHA mortgage payment

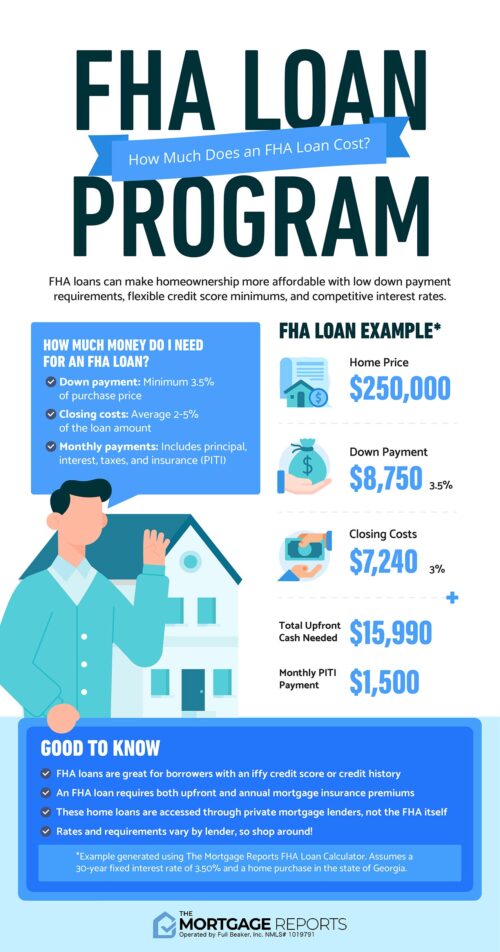

https://themortgagereports.com/fha-loan-calculator A property that meets FHA standards or is eligible for FHA 203k financing; A loan amount within 2022 FHA loan limits; currently $420,680 in most counties. These ...

A property that meets FHA standards or is eligible for FHA 203k financing; A loan amount within 2022 FHA loan limits; currently $420,680 in most counties. These ...

What is a 203k loan?

A 203K loan is an FHA-approved loan designed specifically for people who would like to finance and renovate their homes. This type of loan allows borrowers to purchase and improve their home at the same time while potentially getting better terms and lower interest rates compared to traditional mortgages.

What are the benefits of a 203k loan?

There are several benefits that come with getting a 203k loan, including competitive interest rates that may be lower than traditional mortgage loans, flexible terms based on the borrower's income, no requirement for private mortgage insurance (PMI), and use of funds for renovations without needing additional capital or taking out more debt.

Are there any restrictions on how I can use my 203k Loan ?

Generally speaking, funds from a 203K Loan must be used for necessary repairs or improvements to the property being purchased or refinanced. This includes work done on structural components such as roofs, decks, patios, floors, windows, etc., as well as c062mechanical updates such as plumbing systems or heating/cooling systems. Funds cannot be used for luxury items such as swimming pools or Jacuzzis.

Conclusion:

The 203K Loan is a great way to finance your dream home in Alabama while also getting improved terms than traditional mortgages. It's important to understand how it works so that you can make sure you're making the right financial decisions when it comes to financing your future home. If you have any further questions about what a 203K Loan Alabama can do for you contact your local lender today!