When you’re looking for the perfect ride, the 2012 Chevrolet Camaro is a great choice. Its raw performance and unique look make it an excellent addition to any collection. While its affordability and dependability make it a great everyday car. As with any car purchase, insurance costs are an important factor in your decision-making process. Here’s some information on 2012 Chevrolet Camaro insurance costs

Table Of Content:

- Chevrolet Camaro Insurance Cost & Quotes | SmartFinancial

- How much is car insurance on a 2012 Camaro?

- Chevrolet Camaro Car Insurance Cost: Compare Rates Now | The ...

- How Much Is Car Insurance for a Chevrolet Camaro? - ValuePenguin

- 2012 Chevrolet Camaro Prices, Reviews, & Pictures | U.S. News

- 2012 Camaro Insurance Cost for 16, 17, 18, 19, 20, 21 Year Old

- Lower Your 2012 Chevrolet Camaro Car Insurance Cost

- Chevrolet Camaro Insurance Cost [How to Find Cheap Rates]

- Insurance on Camaro: Everything You Need to Know

- Top 10 CAMARO INSURANCE COST Answers

1. Chevrolet Camaro Insurance Cost & Quotes | SmartFinancial

https://smartfinancial.com/vehicles/chevrolet/camaro Chevrolet Camaro Insurance Model Year by Age Group ; 2012, $338.22 / mo, $193.89 / mo, $134.94 / mo, $124.37 / mo ; 2011, $304.81 / mo, $192.04 / mo, $118.97 / mo ...

Chevrolet Camaro Insurance Model Year by Age Group ; 2012, $338.22 / mo, $193.89 / mo, $134.94 / mo, $124.37 / mo ; 2011, $304.81 / mo, $192.04 / mo, $118.97 / mo ...

2. How much is car insurance on a 2012 Camaro?

https://www.carinsurance101.com/how-much-is-car-insurance-on-a-2012-camaro/Mar 13, 2020 ... Car insurance rates for the 2012 Camaro are similar to previous years with the vehicle and are in-line with the competition, including the Ford ...

3. Chevrolet Camaro Car Insurance Cost: Compare Rates Now | The ...

https://www.thezebra.com/auto-insurance/vehicles/chevrolet/camaro/ 2012 Chevrolet Camaro. Cheapest Insurance Companies. Average Annual Cost. Erie. $620. GEICO.

2012 Chevrolet Camaro. Cheapest Insurance Companies. Average Annual Cost. Erie. $620. GEICO.

4. How Much Is Car Insurance for a Chevrolet Camaro? - ValuePenguin

https://www.valuepenguin.com/chevrolet-camaro-car-insurance

5. 2012 Chevrolet Camaro Prices, Reviews, & Pictures | U.S. News

https://cars.usnews.com/cars-trucks/chevrolet/camaro/2012 Jan 5, 2016 ... The 2012 Chevrolet Camaro is ranked #1 in 2012 Affordable Sports Cars by U.S. News ... How Much Does It Cost to Insure a Chevrolet Camaro?

Jan 5, 2016 ... The 2012 Chevrolet Camaro is ranked #1 in 2012 Affordable Sports Cars by U.S. News ... How Much Does It Cost to Insure a Chevrolet Camaro?

6. 2012 Camaro Insurance Cost for 16, 17, 18, 19, 20, 21 Year Old

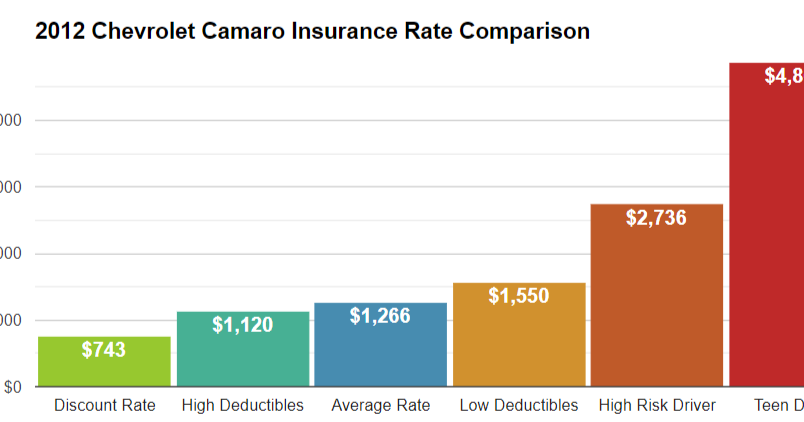

https://freeinstantcarinsurancequotesonline.blogspot.com/2020/09/2012-camaro-insurance-cost.html Sep 17, 2020 ... Normal insurance rates for a 2012 Chevrolet Camaro Insurance Cost are $1,266 every year for full coverage. Extensive insurance costs around ...

Sep 17, 2020 ... Normal insurance rates for a 2012 Chevrolet Camaro Insurance Cost are $1,266 every year for full coverage. Extensive insurance costs around ...

7. Lower Your 2012 Chevrolet Camaro Car Insurance Cost

https://www.quoteinspector.com/2012-chevrolet-camaro-insurance-premium-cost/ May 12, 2022 ... Why are 2012 Chevy Camaro insurance rates so high? Learn what factors are pushing your rates up and you can discover the proper way to get a ...

May 12, 2022 ... Why are 2012 Chevy Camaro insurance rates so high? Learn what factors are pushing your rates up and you can discover the proper way to get a ...

8. Chevrolet Camaro Insurance Cost [How to Find Cheap Rates]

https://www.buyautoinsurance.com/cars/chevrolet/camaro/![Chevrolet Camaro Insurance Cost [How to Find Cheap Rates]](https://www.buyautoinsurance.com/wp-content/uploads/2021/04/bai-site-logo.png) Jul 15, 2021 ... Average auto insurance rates for a Chevrolet Camaro cost $1472 a year, or around $123 a ... 2012 Chevrolet Camaro, $248, $400, $460, $1,266.

Jul 15, 2021 ... Average auto insurance rates for a Chevrolet Camaro cost $1472 a year, or around $123 a ... 2012 Chevrolet Camaro, $248, $400, $460, $1,266.

9. Insurance on Camaro: Everything You Need to Know

https://www.caranddriver.com/car-insurance/a37167802/insurance-on-camaro/

Jul 29, 2021 ... Average Camaro Auto Insurance Rates. The insurance website ValuePenguin reviewed Camaro car coverage rates for eight model years and found an ...

10. Top 10 CAMARO INSURANCE COST Answers

https://campinghiking.net/insurance/camaro-insurance-cost/

Sep 17, 2020 — Normal insurance rates for a 2012 Chevrolet Camaro Insurance Cost are $1,266 every year for full coverage. Extensive insurance costs around…

Q: How much will I pay for insurance on a 2012 Camaro?

The cost of auto insurance for a 2012 Chevrolet Camaro varies depending on factors such as age, driving record, and location. However, drivers can expect to pay around $1,500 - $2,000 per year for full coverage

What factors affect my insurance rate?

Your age, driving record, and where you live all affect your car insurance rates. Some insurers also consider other factors such as credit score or type of vehicle. Each insurer has their own set of criteria when calculating premiums

Are there any discounts available?

Many insurers offer discounts for safe drivers or those with multiple vehicles on their policy. Other discounts may include low mileage discounts or loyalty programs

Does the size of the engine affect my rate?

Yes, the size of the engine does play a role in determining your premium rate. Generally speaking, larger engines may lead to higher rates because they carry more risk

Conclusion:

Making sure you have enough coverage is an important part of owning a car like the 2012 Chevrolet Camaro. By doing some research and shopping around, you can find an affordable policy that meets your needs. Whether you’re looking for full coverage or just liability protection, comparing policies from various companies can save you money while ensuring that you stay protected.